Uber is making its Uber Eats service available from the main ride-share app in certain markets, with the hopes that cross-promoting its services could improve customer acquisition and retention for the company. TechCrunch reports that a web view version of Uber Eats is now embedded into the company’s ride-share app, which means users hailing a ride can order food without having to download and/or open the Uber Eats app separately.

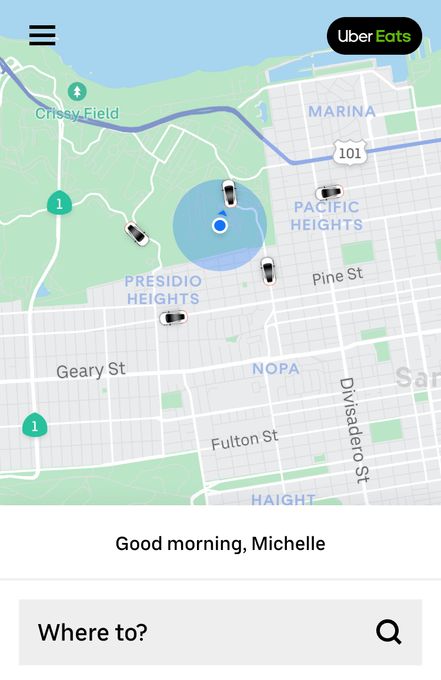

Uber is currently testing this version in markets that don’t offer bikes or scooters. The company made the version available to iOS users in April, and as TC reports, it’s now rolling the functionality out to Android users, too. By clicking on the Uber Eats button placed in the top-right corner of the main app, users can automatically access Uber Eats functionality and order a meal while en route to their destination.

The hope is that offering this kind of seamless relationship between the two services will increase users for both Eats and the ride-sharing app. If it works, the integration could give Uber Eats an edge when it comes to keeping customers within the brand’s ecosystem. Not long ago, tech company Second Measure released data that indicates customer loyalty to any single brand in the third-party delivery space is declining, partly because of the number of options now available. By cross-promoting its services, Uber would potentially be able to persuade those who have never used Eats to try the service without forcing them to download yet-another app. And as Uber’s S-1 filing from April suggests, more Uber Eats customers can help boost overall usage for the company, whose stocks are currently down 5 percent from when it debuted on the NYSE in April.

And if the rumors are true, a forthcoming $9.99/month loyalty program, which a blogger discovered last month via hidden code within the Uber Eats app, could further boost the company’s lagging loyalty numbers. Said program has yet to be confirmed by the company, but if it does officially launch, it’s yet-more incentive for users to stay in the Uber world.